Short term loans from SteadyPay

CashWave

Get Up To £500 💸

Repay in monthly instalments, no interest.

Representative APR 91.25%. We do not charge interest. The APR depicts the subscription as the cost of using our service.

Representative example: amount advanced: £300. Interest charged: 0%. Subscription paid: £90 (£30 x 3). Total amount paid: £390. Repayment over 120 days. Representative APR: 91.25%

Sign Up to CashWave through the SteadyPay app:

How to get started

Install the SteadyPay app and access up to £500, with no added interest.

Subject to status.

CashWave is a subscription service costing £30 per month. We do not charge interest, only the cost of subscription.

Our Products

CashWave 💸

£500 over three months.

Credit Builder 🏢

Boost your credit score.

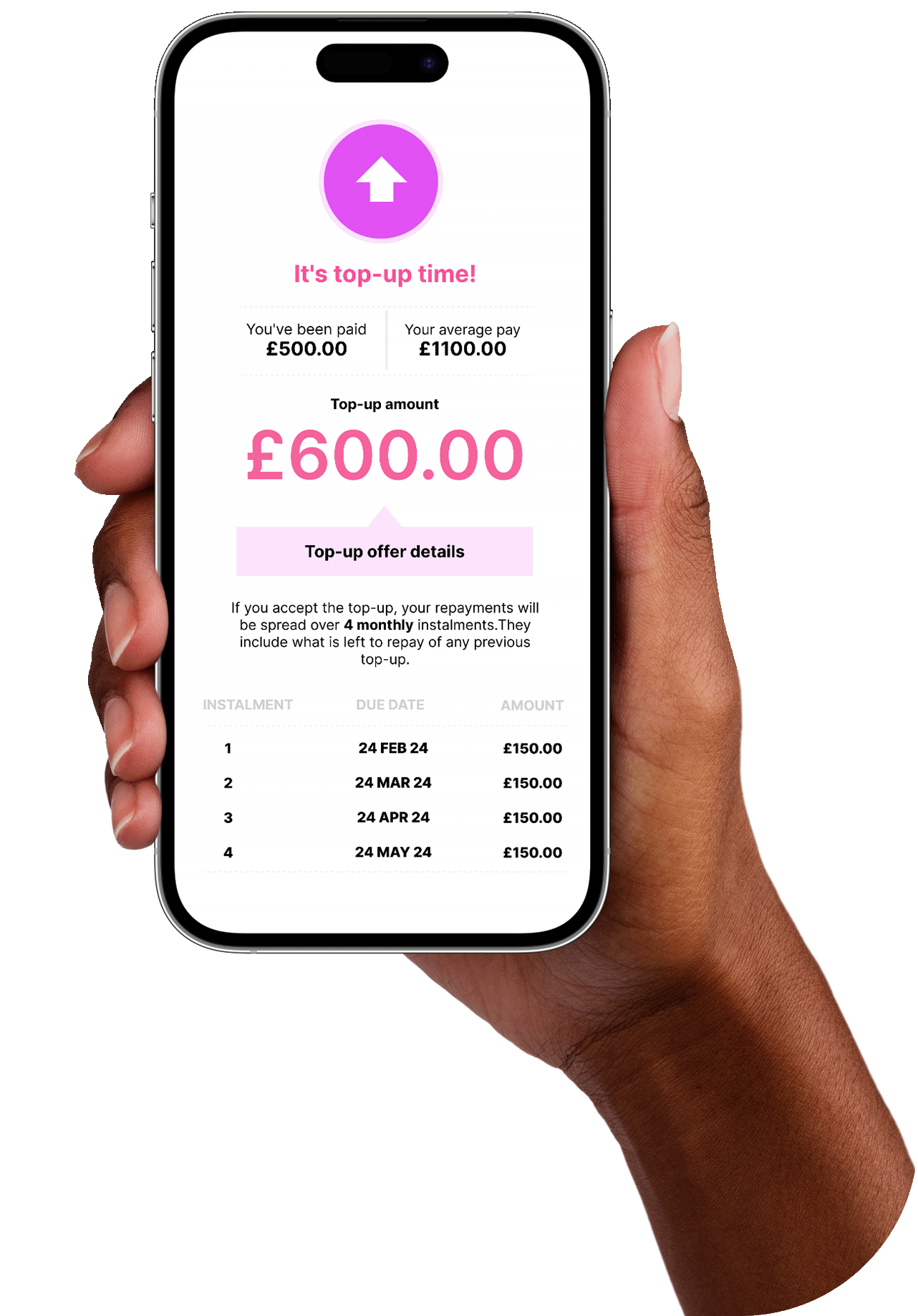

TopUp ⬆️

Get regular income top ups.

-

Great for people with bad credit and fluctuating pay.

Rebecca M

Google Play Store -

I was very weary about signing up for this app but honestly it's 1 of the smartest decisions I made. I recommend it to anyone.

Kathleen M

Google Play Store -

SteadyPay has been a lifesaver to say the least... More helpful than your traditional bank.

Debscd (Username)

Apple App Store -

Customer service spot on rapid replies and from people who actually read and respond properly to the question or issue.

David J

Google Play Store

Want to build your credit score?

Credit Builder 🏢

Elevate your credit rating fast with SteadyPay.

With every payment you make, you're not just managing your short-term financial needs—you're actively building a stronger credit record.

Access CreditBuilder through the SteadyPay app:

TopUp ⬆️

When you get paid less than usual, we advance you money. The top-ups bring your income back to usual, protecting you when you work fewer hours or take time off.

Representative APR: 36.4%

We do not charge interest. The APR depicts the subscription as the cost of using our service.

Representative example: Top-ups advanced: £1000. Interest charged: 0%. Subscription paid: £364 (£7 a week x 52). Total amount paid: £1364. Representative cost: 36.4%

Access IncomeSmoothing through the SteadyPay app:

Super secure

We never see or store your bank login details. All data is encrypted and transmitted to your bank over a secure channel.

SteadyPay can’t be used to move money; it has ‘read-only’ access. The app is restricted to checking your account so it knows if you're due a top-up or can repay a top-up.

Important information

When you apply to SteadyPay we do a credit check.

To activate the service you must have paid the subscription for two weeks. To keep the service active you must keep up to date with your subscription and repayments.

You must be employed. You qualify for top-ups when the pay you receive from your employer is less than usual.

The minimum top-up is £25. Your top-up facility has a £1,000 credit limit. All top-ups are subject to affordability checks.

Need support?

If you’ve got a question, concern, or something’s not quite right—we’re here to help. Whether it’s an issue with your account or a complaint you’d like us to look into, our team is ready to listen and support you.