A new kind of credit

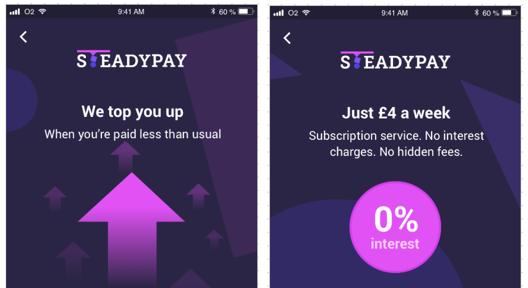

We want to challenge the way banks and lenders make money.When we looked around for inspiration, it came from modern businesses that don't operate in financial services. Think Netflix and Spotify. They make money by charging a subscription fee.We replicated this with SteadyPay because we believe it's a transparent way of doing business. Unlike overdrafts, you don't have to comb through the fine print to uncover charges – because there's nothing hidden.It's also a simple way of doing business. You don’t have to get out the calculator to work out the total cost – it's the subscription fee and whatever top-ups you borrow, nothing more.Ultimately, it's a responsible way of doing business. Because we don't charge interest, we have no incentive to keep you in debt. Because we don't charge interest, you’re not at risk of falling into a debt spiral with us.

We want to challenge the way banks and lenders make money.When we looked around for inspiration, it came from modern businesses that don't operate in financial services. Think Netflix and Spotify. They make money by charging a subscription fee.We replicated this with SteadyPay because we believe it's a transparent way of doing business. Unlike overdrafts, you don't have to comb through the fine print to uncover charges – because there's nothing hidden.It's also a simple way of doing business. You don’t have to get out the calculator to work out the total cost – it's the subscription fee and whatever top-ups you borrow, nothing more.Ultimately, it's a responsible way of doing business. Because we don't charge interest, we have no incentive to keep you in debt. Because we don't charge interest, you’re not at risk of falling into a debt spiral with us.