An alternative to overdrafts

"So how are you different from overdrafts?"It's a question we get asked occasionally. It's a simple question, but one that goes to the heart of what SteadyPay’s about.The answer largely concerns design intent.Overdrafts are designed to be a quick fix. They address a symptom of the problem (“I need money to pay for this thing now!”).SteadyPay is designed to be a long-term fix for those paid by the hour. This is done by addressing a root cause of the problem (“Why am I short of money again?”).

Pay smoothing

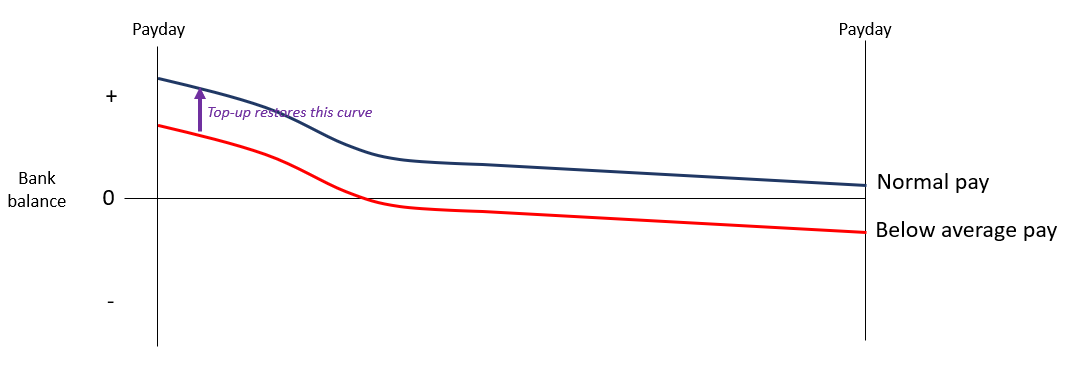

Those paid by the hour at some point have to deal with dips in pay. These dips can happen for many reasons - taking time off for colds, going on holidays, getting rostered fewer hours, booking fewer gigs, losing shifts with bonus rates, not earning commission.Dips in pay trigger borrowing. Dips in pay make budgeting difficult.By providing credit to offset these dips in pay, we reduce the need to go into overdraft (or take out a payday loan or max out the credit card), certainly when we're talking about dealing with everyday expenses. This is illustrated in the image below. The top-ups smooth out income, allowing our customers to enjoy predictable pay. This is a key condition for successful budgeting.Indeed, and this is an important point, because the credit can only be accessed when a certain condition is met - lower than usual pay - the top-ups support responsible spending on everyday essentials. Credit on tap carries the risk of enabling impulse buying.The top-ups also allow our customers to take, in effect, paid leave. The top-ups can be used to bring pay back up to usual after time off for a holiday or to get over a cold.

The top-ups smooth out income, allowing our customers to enjoy predictable pay. This is a key condition for successful budgeting.Indeed, and this is an important point, because the credit can only be accessed when a certain condition is met - lower than usual pay - the top-ups support responsible spending on everyday essentials. Credit on tap carries the risk of enabling impulse buying.The top-ups also allow our customers to take, in effect, paid leave. The top-ups can be used to bring pay back up to usual after time off for a holiday or to get over a cold.

Minimising the cost of debt

Our business model emphasises the difference in design intent.Banks make money from overdrafts (especially unarranged overdraft) by charging interest and a bunch of fees. To put it bluntly, banks look to maximise the cost of debt. It’s how they earn billions of pounds.An outcome of this business model is that many people get stuck in a vicious cycle of borrowing.According to research by StepChange, 2.1 million people in the UK go into overdraft every month of the year. The average overdraft debt among people seen by StepChange is £1722. Repayment of such debts swallows up income and leaves little for everyday essentials.SteadyPay makes its money from a small subscription fee. That’s it. No interest charges. No penalty fees. We minimise the cost of debt. We’re focused on providing a financial solution, not on pushing a financial product.

Not mutually exclusive services

In the end, SteadyPay and overdrafts are not mutually exclusive financial services. Overdrafts come into their own when there's a sudden, large expense. SteadyPay supports the wider use-case of everyday expense management, especially when facing dips in pay, and carries no risk of falling into a debt spiral.If you’ve an idea on how to improve SteadyPay, we’d love to hear it. Email [email protected].