The Darkside of Being A Digital Nomad | Guest Publication with Startups Magazine

The freedom to work from anywhere has a certain allure that's hard to resist. As WiFi becomes ubiquitous and remote work more of the norm, the world becomes your office.

But let's talk about what often goes unmentioned—the fact that digital nomads struggle with credit access, particularly fairly priced credit, even in a startup-rich financial climate.In this article, recently published in Startups Magazine, our founder, John Downie, discusses the challenges that digital nomads face in accessing credit and financial services.

💡 A digital nomad works online and can travel anywhere while doing their job.

Digital Nomads Struggle with Credit Access

For many, access to credit is like oxygen for financial growth—it's critical for emergencies, long-term investments, and even daily cash flow. Yet, despite being at the forefront of work model transformation, digital nomads often find themselves choking in this vital aspect. Why? Because they just don't fit the mould that traditional credit systems were designed for. I’ve previously written on the UK's outdated credit systems, and similar pitfalls apply here, only amplified.

Why Current Credit Models Fail

Traditional credit systems are deeply flawed for digital nomads. Think about it. These systems favour the 9-to-5 job and a home base — elements that just don't fit the nomad's roaming lifestyle. And the data they use is so limited in scope that it doesn't accurately portray someone's creditworthiness.The challenge here isn't just about adapting old systems, it's about forging new partnerships and developing an ecosystem that includes fintech and traditional finance working in tandem. The inertia of large legacy systems and traditional ways of working are barriers. But when pain points turn into lost customer share, motivation will surge. It’s a classic case of evolve or get left behind, and my belief in a thriving fintech ecosystem.

A Credit Building Case Study

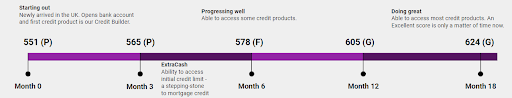

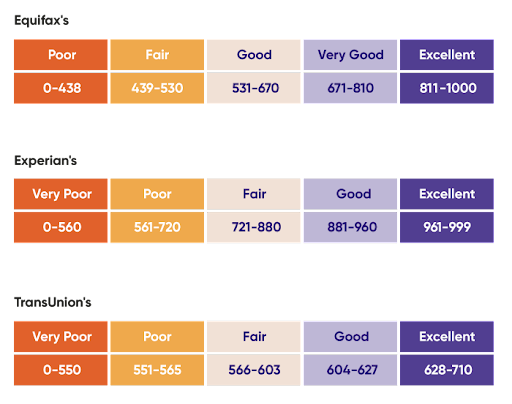

Customers on average move up 1 score band every 4-6 months. Let’s look at Maria as an example, she moved to the UK and starts with a Poor credit score of 551, starts using the SteadyPay credit builder, within 6 months score has increased to 578 which is Fair. By month 12 the score is 605 which is Good. The benefits are clear at this point significant increase in credit eligibility and reduction in interest rate (cost) paid for the credit.

Challenges Across Borders

If you're a nomad who hops across borders, things get even more complicated. How do you establish a reliable credit history when you're not tethered to one country? Currency fluctuation, international laws, and the absence of a permanent address all pile on to make the nomad lifestyle financially unattractive for traditional lenders.This is where open banking and APIs come into play. They're a start, giving us a peep into a future where financial behaviour can be evaluated in a more holistic, borderless manner. Yet, this vision is stymied by the current reality: open banking is largely country-specific. It's like having a puzzle where each piece belongs to a different set – they just don't fit together to create a coherent picture for global workers. A real solution would demand a global approach to open finance, something that evades even global banks due to the strict regulatory frameworks they operate within.

The Misconception of Instability

Traditional lenders view digital nomads through a lens smudged with misconceptions. They see these global professionals as transient thrill-seekers, not serious clients. This couldn't be further from the truth. Digital nomads are often highly skilled, hardworking individuals with a keen sense of what they need to thrive both personally and professionally. The idea that they are financially irresponsible is a narrative that needs to change.

Financial Fluidity and the Modern Economy

And then there's the concept of 'financial fluidity' – a term that traditional credit systems have trouble wrapping their heads around. They often dismiss it as either a threat to the status quo or irrelevant noise. But here's the crux: In a fast-moving world, the lack of a traditional financial footprint and access to real-time data is far from insignificant. It's precisely these fresh pieces of information that can paint a more accurate picture of someone's financial health.

Potential Solutions

We are not short of technology that could solve these problems. Machine learning, for instance, has the capability to parse complex data patterns to provide a nuanced understanding of creditworthiness. It's not just about more data, but better data, and making sense of this data in a way that fits the digital nomad's lifestyle.The real quandary is whether credit reference agencies (CRAs) and traditional financial systems can shift their perspectives. Can they become friends with the new ways of working, or will they remain on the outside looking in? If CRAs can integrate fintech innovations that capture the essence of financial fluidity, they might not just survive but thrive.The freedom to work from anywhere should not be paired with financial shackles. It's crucial for financial institutions to recognize and adapt to the fluidity of modern work lifestyles. We're at a crossroads – will the financial systems flex to accommodate the digital nomad, or will they crumble, relics of a bygone era? As we champion change, let's ensure we're also building bridges – because a world that's financially inclusive for digital nomads is a richer world for all of us.Source: https://startupsmagazine.co.uk/article-dark-side-being-digital-nomad-zero-access-fairly-priced-credithttp://startupmagazine.co.uk/