What goes into a credit score?

Your credit score is a number that lenders refer to when they assess your application for a loan or credit card.

Your credit score summarises your credit history. It is calculated using information such as your:

- Credit payment history (are your loan and credit card payments made on time)

- Amount of credit used (do you max out your credit card, how much of your loan is there left to pay off)

- Age of credit history (how long have you had a loan or credit card)

- Credit mix (do you have revolving credit like a credit card, instalment credit like car finance, long term secured credit like a mortgage, short term unsecured credit like a payday loan)

The major credit agencies – TransUnion, Equifax, Experian – calculate your credit score using reports provided by lenders. Each agency has their own proprietary scoring method, so your score will vary between these agencies.

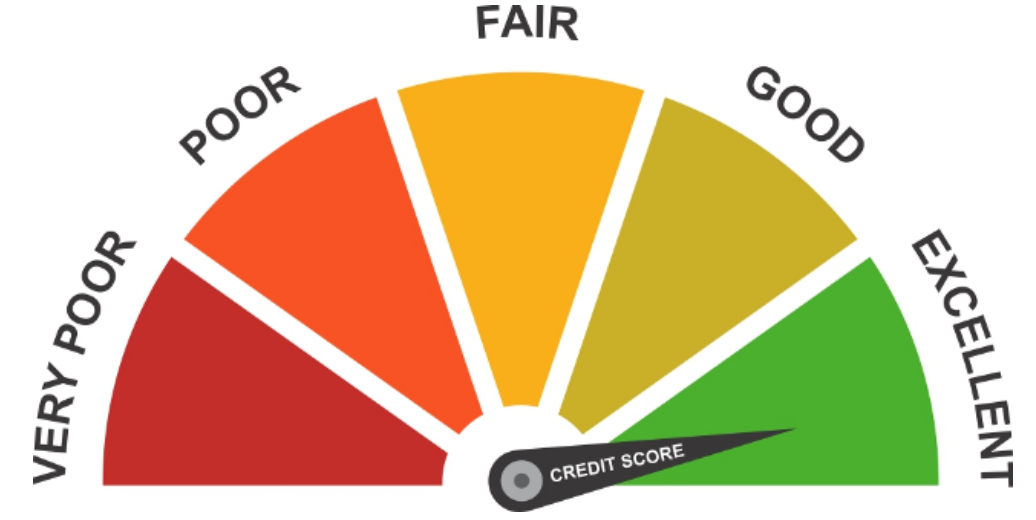

The scores typically range from 300 to 850. The overall pattern is the same – the higher your credit score, the better your standing will be with lenders.

Your credit score is not the only thing lenders will look at when assessing your application. They will also look at your employment status, your income, your expenses and your debt-to-income ratio. But having a good credit score is important. It not only increases your chances of approval, it also increases your ability to negotiate a better interest rate.

A great place to start is to view the information held on you by the major credit agencies. Check out their respective websites for instructions.