A socially responsible credit service

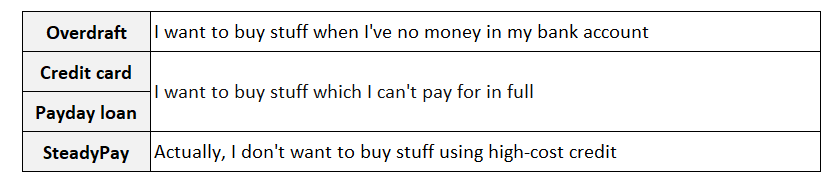

In our very first blog, we discussed how SteadyPay is different to overdrafts. We thought we'd revisit this, but also look at credit cards and payday loans.

In our very first blog, we discussed how SteadyPay is different to overdrafts. We thought we'd revisit this, but also look at credit cards and payday loans.

Purpose

Overdrafts can help when your bank account is in meltdown and there's a bill to pay urgently. However, if you find yourself relying on this service to cover everyday expenses, then you're only addressing the symptom of the problem ("I need money") rather than the cause ("why am I short of money again?"). This leads to taking on more and more debt. According to Step Change, 2.1 million people in the UK are stuck in overdraft.Credit cards can be useful...but dangerous. They enable impulse buying. Indeed, reward schemes are designed to encourage you to spend and spend. Interest free starter periods can promote bad repayments behaviour. And if you tend to make minimum monthly repayments, you're at risk of falling into a debt spiral - Money Charity observes that it would take over 26 years to repay a credit card with average interest.And payday loans? They provide a short-term borrowing option but as the saying goes, buyer beware.SteadyPay is designed to reduce the need to use these types of credit. The first way we do this is by addressing a root cause of the cash flow problem - dips in pay. These typically happen when you work fewer shifts or take time off sick or go on holiday. By topping up pay, we provide predictable, reliable income. You need this to budget confidently for everyday finances.

Overdrafts can help when your bank account is in meltdown and there's a bill to pay urgently. However, if you find yourself relying on this service to cover everyday expenses, then you're only addressing the symptom of the problem ("I need money") rather than the cause ("why am I short of money again?"). This leads to taking on more and more debt. According to Step Change, 2.1 million people in the UK are stuck in overdraft.Credit cards can be useful...but dangerous. They enable impulse buying. Indeed, reward schemes are designed to encourage you to spend and spend. Interest free starter periods can promote bad repayments behaviour. And if you tend to make minimum monthly repayments, you're at risk of falling into a debt spiral - Money Charity observes that it would take over 26 years to repay a credit card with average interest.And payday loans? They provide a short-term borrowing option but as the saying goes, buyer beware.SteadyPay is designed to reduce the need to use these types of credit. The first way we do this is by addressing a root cause of the cash flow problem - dips in pay. These typically happen when you work fewer shifts or take time off sick or go on holiday. By topping up pay, we provide predictable, reliable income. You need this to budget confidently for everyday finances.

Costs

The second way we do this is by minimising the cost of borrowing. The pay top-ups are interest free. There are no rip-off fees like charging for late payments. The only cost is a low, weekly subscription.Overdrafts, credit cards and payday loans are designed to maximise the cost of borrowing through a combination of charging interest and a collection of fees. Overdrafts can be the worst offender. The Guardian reported that exceeding an overdraft by £100 for just one week can cost £76 in fees. No wonder banks earn more than £2.3 billion a year from overdraft charges.

The second way we do this is by minimising the cost of borrowing. The pay top-ups are interest free. There are no rip-off fees like charging for late payments. The only cost is a low, weekly subscription.Overdrafts, credit cards and payday loans are designed to maximise the cost of borrowing through a combination of charging interest and a collection of fees. Overdrafts can be the worst offender. The Guardian reported that exceeding an overdraft by £100 for just one week can cost £76 in fees. No wonder banks earn more than £2.3 billion a year from overdraft charges.

A responsible credit service

SteadyPay is a responsible credit service because there's no debt trap: you only pay back what your borrow (the top-ups) plus a low fixed cost (the subscription). Other credit services have variable costs due to interest charges and a collection of fees. Miss a repayment or minimise the repayments, and suddenly you can be in a world of hurt.

SteadyPay is a responsible credit service because there's no debt trap: you only pay back what your borrow (the top-ups) plus a low fixed cost (the subscription). Other credit services have variable costs due to interest charges and a collection of fees. Miss a repayment or minimise the repayments, and suddenly you can be in a world of hurt.