SteadyPay versus overdrafts

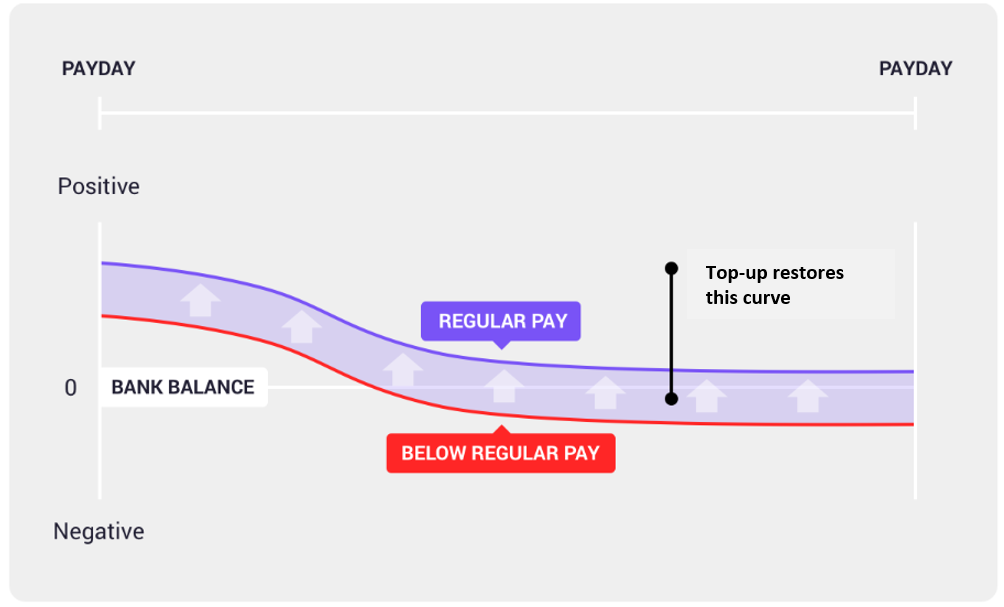

Overdrafts are designed to be a quick fix. This means they address a symptom of the problem ("I need money to buy this thing now!"), rather than the root cause ("Why am I short of money again?").Our service is designed to get at the root cause and help you stay on top of your everyday finances. We do this by topping you up when you earn less than your usual level of pay.  As illustrated above, this smooths out your pay. This eases the pressure on your bank account, helping you to budget and reducing the risk of falling into overdraft.At first, it might seem strange that credit can only be accessed when you're paid below your usual level. This is because we want to support your efforts to budget for everyday essentials, not enable impulse buying. In other words, we’re there for when you need us rather than for when you want us.An overdraft can be a costly type of loan, with many banks charging 40% interest. Indeed, overdrafts have been a major source of profit for banks. In 2017, banks made £2.7 billion from overdraft charges.We don't charge any interest. The only thing we charge is a flat, weekly subscription fee which gives you access to £1000 credit for topping up your pay. We like to keep things simple.

As illustrated above, this smooths out your pay. This eases the pressure on your bank account, helping you to budget and reducing the risk of falling into overdraft.At first, it might seem strange that credit can only be accessed when you're paid below your usual level. This is because we want to support your efforts to budget for everyday essentials, not enable impulse buying. In other words, we’re there for when you need us rather than for when you want us.An overdraft can be a costly type of loan, with many banks charging 40% interest. Indeed, overdrafts have been a major source of profit for banks. In 2017, banks made £2.7 billion from overdraft charges.We don't charge any interest. The only thing we charge is a flat, weekly subscription fee which gives you access to £1000 credit for topping up your pay. We like to keep things simple.