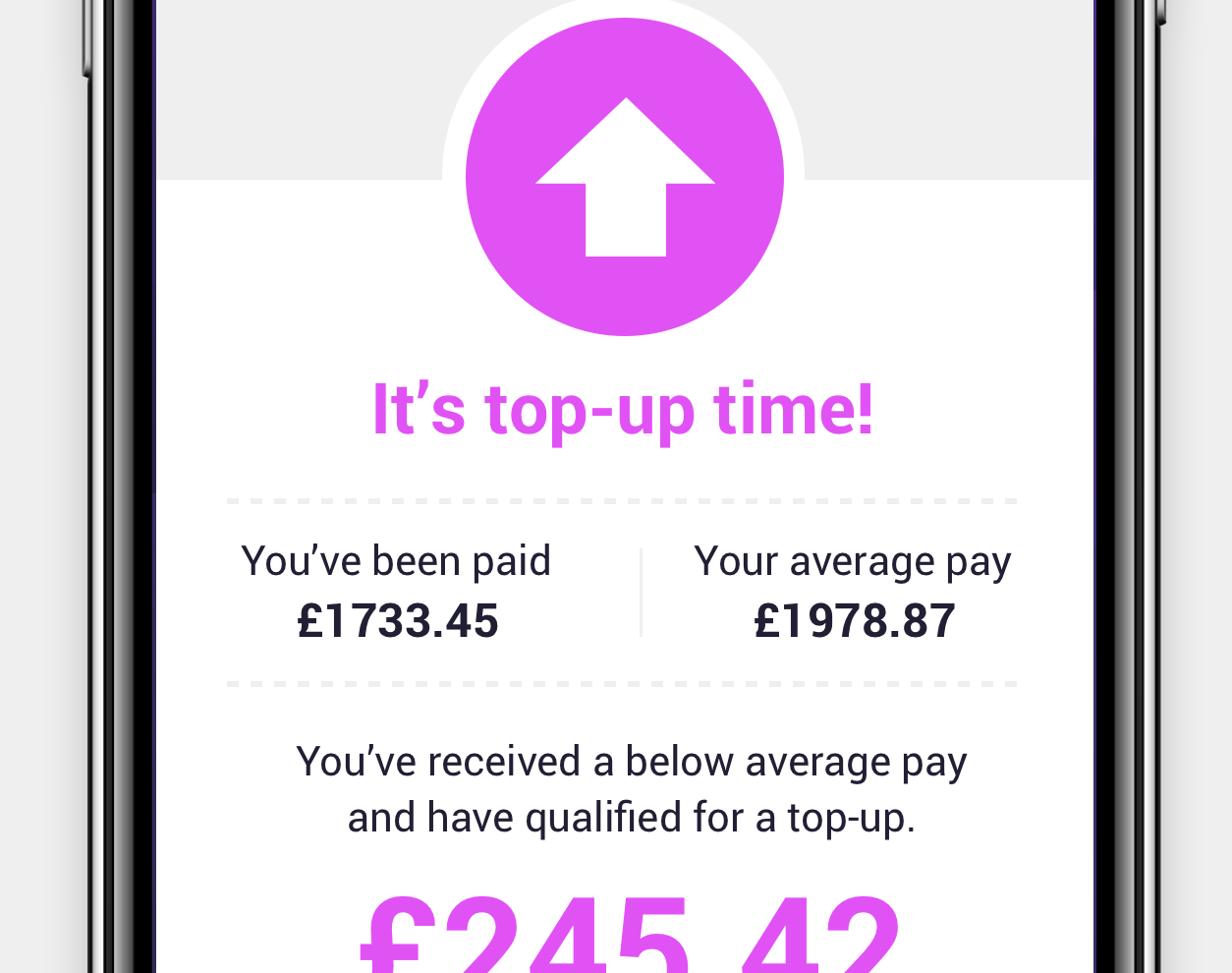

When you get paid less than usual, we advance you money. The top-ups bring your income back to usual, protecting you when you work fewer hours or take time off.

We partner with credit agencies, giving you the opportunity to build your credit score.

Need to sort out an urgent expense? No worries. You can drawdown a fixed amount of money from your top-up facility.

£7

only

Representative APR 36.4%

We do not charge interest. The APR depicts the subscription as the cost of using our service.

Representative example: Top-ups advanced: £1000. Interest charged: 0%. Subscription paid: £364 (£7 a week x 52). Total amount paid: £1364. Representative cost: 36.4%

The app connects to your main bank. Our tech does the rest.

The app monitors your pay. When you get paid below usual we offer you a top-up.

Repay by instalments. Moreover, your repayments refresh your credit for the next top-up.

We report your repayments to the credit agencies, building your credit.

For a reduced fee of only £7 per month, you can get a Credit Building only product.

Get a top up when your pay takes a hit - like when you work fewer shifts, take sick days or go on holiday. We've got you covered.

Calculate your top-upsHow much are you paid? If you’ve more than one job, select the job whose pay you want topped up.

How many unpaid days would you take due to sickness, bank holidays, personal holidays, changes to the shift roster, etc?

We never see or store your bank login details. All data is encrypted and transmitted to your bank over a secure channel.

SteadyPay can’t be used to move money; it has ‘read-only’ access. The app is restricted to checking your account so it knows if you're due a top-up or can repay a top-up.

When you apply to SteadyPay we do a credit check.

To activate the service you must have paid the subscription for two weeks. To keep the service active you must keep up to date with your subscription and repayments.

You must be employed. You qualify for top-ups when the pay you receive from your employer is less than usual.

The minimum top-up is £25. Your top-up facility has a £1,000 credit limit. All top-ups are subject to affordability checks.

Steadypay is a credit service. Failing to make repayments may negatively affect your credit rating. If you need help with managing your debts, you can find more information here: