Fair Banking For All | Proud to be Partners with Fair by Design

In the intricate web of financial dynamics, there exists a phenomenon known as the poverty premium, wherein individuals with lower incomes inadvertently end up paying more for essential services than their higher-income counterparts. This disparity extends across various facets of daily life, from energy bills to insurance premiums, perpetuating a cycle of financial strain for those already struggling to make ends meet.

The Darkside of Being A Digital Nomad | Guest Publication with Startups Magazine

The freedom to work from anywhere has a certain allure that's hard to resist. As WiFi becomes ubiquitous and remote work more of the norm, the world becomes your office.

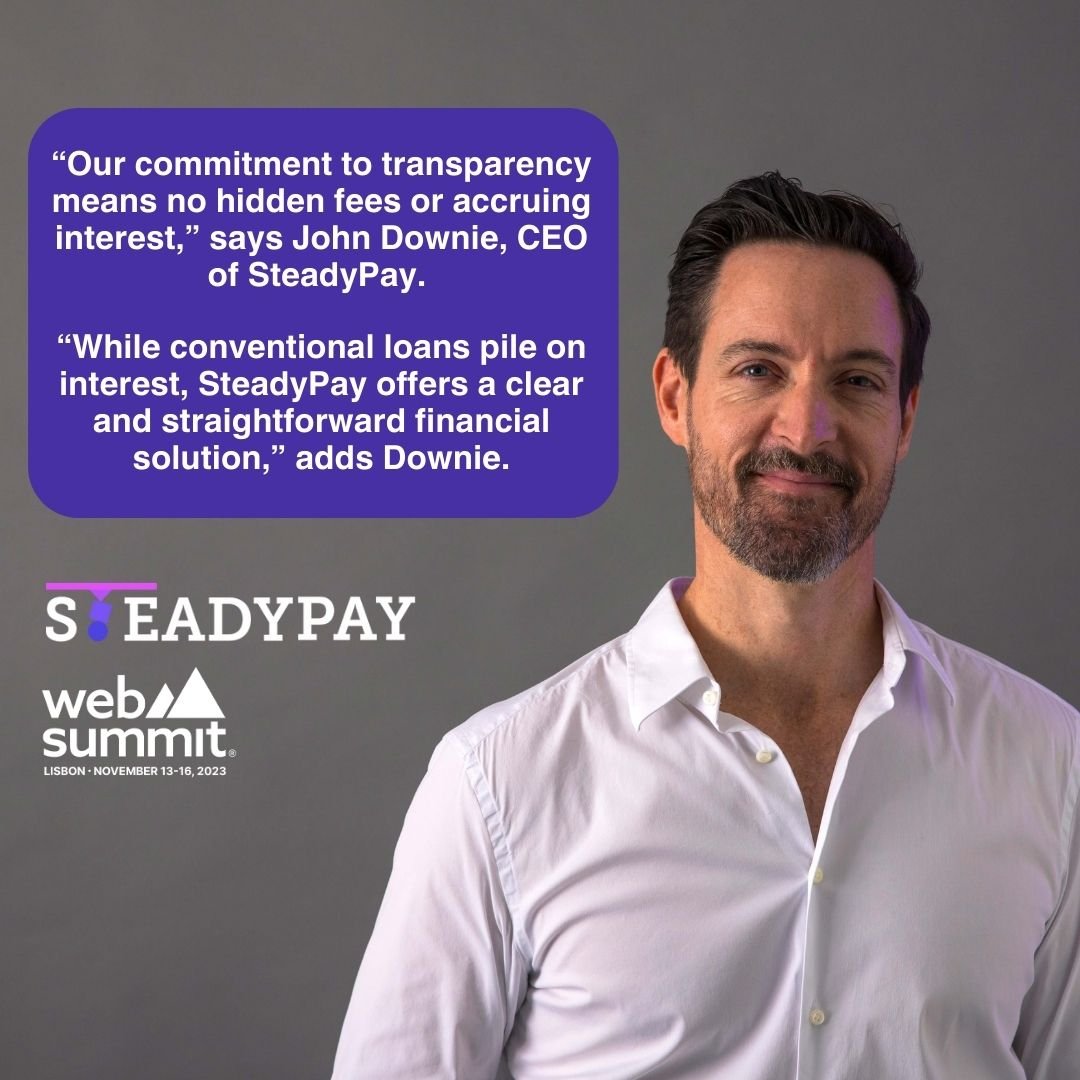

But let's talk about what often goes unmentioned—the fact that digital nomads struggle with credit access, particularly fairly priced credit, even in a startup-rich financial climate.In this article, recently published in Startups Magazine, our founder, John Downie, discusses the challenges that digital nomads face in accessing credit and financial services.

The Ultimate Guide to Managing Debt

In the UK, dealing with debt is a reality for many. It’s not just a number on a statement; it’s a shared challenge that hits both our wallets and peace of mind.

Facing financial uncertainty is tough, and we get it. That’s why understanding and managing debt is crucial—it's about taking control when things feel shaky. In this guide, we’ll cut through the complexity, offering practical strategies to tackle debt head-on. No frills, just straightforward advice to help you navigate these financial waters. Let’s get started on a path towards stability.

Breaking the Payday Loan Cycle: How PayPay loans work

In modern financial landscapes, payday loans have become a prevalent option for many seeking immediate cash. These short-term, high-interest loans serve as a quick-fix solution for individuals facing urgent financial needs. However, they often ensnare borrowers within a detrimental cycle, perpetuating financial instability rather than offering a viable remedy.

Cost of Living Crisis - How SteadyPay is part of the solution

In recent years, the cost of living has soared exponentially, significantly impacting households worldwide. From inflated housing prices to escalating utility bills and the soaring costs of groceries and everyday essentials, individuals and families are grappling with the unrelenting burden of higher expenses.